Sukanya Samridhi Accounts

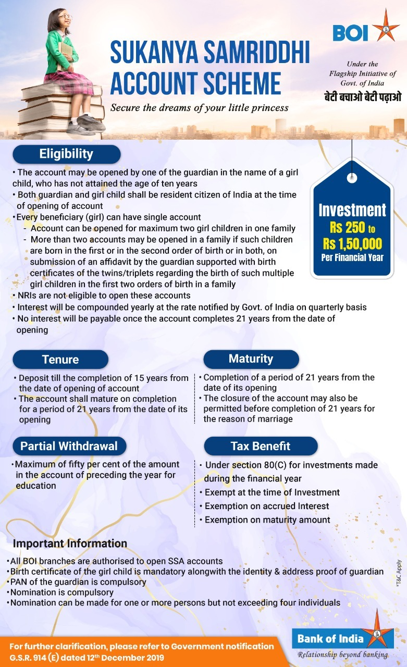

ELIGIBILITY

- The account may be opened by one of the guardian in the name of a girl child, who has not attained the age of ten years.

- Both guardian and girl child shall be resident citizen of India at the time of opening of account.

- Every beneficiary (girl) can have single account.

- Account can be opened for maximum two girl children in one family.

- More than two accounts may be opened in a family if such children are born in the first or in the second order of birth or in both, on submission of an affidavit by the guardian supported with birth certificates of the twins/triplets regarding the birth of such multiple girl children in the first two orders of birth in a family. (Provided further that the above proviso shall not apply to girl child of the second order of birth, if the first order of birth in the family results in two or more surviving girl children.)

- NRIs are not eligible to open these accounts.

DOCUMENTS REQUIRED

- Birth certificate of the girl child is mandatory along with the Identity & address proof of guardian.

- PAN of the guardian is compulsory.

- Nomination is compulsory

- Nomination can be made for one or more persons but not exceeding four individuals

- For further clarification, please refer to Government notification G.S.R. 914 (E) dated 12th December 2019

TAX BENEFIT

EEE Tax benefit under section 80 (C) for investment made during the financial year :

- Exempt at the time of Investment upto Rs 1.5 Lacs

- Exemption on accrued Interest

- Exemption on maturity amount.

INVESTMENT

- The account can be opened with the minimum amount of Rs. 250 and thereafter subsequent deposits in multiples of Rs. 50 can be made in the account.

- The minimum contribution is Rs. 250 while maximum contribution is Rs. 1,50,000 per financial year till 15 years from the date of account opening.

RATE OF INTEREST

- Presently, accounts opened under SSY earns an annual interest of 8.00% . However, the interest rate is notified quarterly by Government of India.

- Interest will be compounded yearly and credited to the account at the end of the financial year.

- Interest for one calendar month will be calculated on the lowest balance between close of 5th day & last day of the month.

- No interest will be payable once the account completes twenty-one years from the date of opening.

TENURE

- Deposits will be made in the account till the completion of 15 years from the date of opening of account.

- The account will mature on completion of a period of 21 years from the date of its opening.

ACCOUNT CLOSURE

- Closure on Maturity: The account shall mature on completion of a period of twenty-one years from the date of its opening. The balance outstanding along with interest as applicable shall be payable to the account holder.

- Closure before 21 years is permitted if the account holder on an application makes a request for such closure for the reason of intended marriage of the account holder on furnishing of a declaration duly signed on non-judicial stamp paper attested by the notary supported with proof of age confirming that the applicant will not be less than eighteen years of age on the date of marriage.

PARTIAL WITHDRAWAL

- Withdrawal up to a maximum of 50% of the amount in the account at the end of the financial year preceding the year of application for withdrawal, shall be allowed for the purpose of education of the account holder.

- Such withdrawal shall be allowed only after the account holder has attained the age of 18 years or has passed 10th standard, whichever is earlier.

Sukanya Samridhi Accounts

Account opening is available at all BOI branches near you.

- An individual may open an account on behalf of maximum 2 daughters whose age is less than 10 years.

DOCUMENTS REQUIRED

- A recent passport size photograph of guardian and a/c holder.

- Birth Certificate of girl child.

Proof of address and identification for guardian

- Aadhar card

- Passport

- Driving license

- Voter’s ID card

- Job card issued by NREGA signed by the State Government officer

- Letter issued by the National Population Register containing details of name and address.

- PAN Card

TRANSFER TO BOI

- Sukanya Samridhhi account can be transferred from any other bank/post office to your nearest BOI branch.

STANDING INSTRUCTION

- For ease of depositing the contribution and avoid any penalty for non deposit, BOI provides auto deposit facility in SSY account from your bank account starting from Rs. 100 only. Apply online or visit your branch.

- Click here for redirecting to Internet banking

Sukanya Samridhi Accounts

Customers can transfer their existing Sukanaya Samriddhi Account held with other bank/ Post Office to Bank of India :-

- Customer needs to submit SSY Account Transfer Request at existing bank/ Post Office mentioning address of Bank of India branch.

- The existing bank/ Post Office shall arrange to send the original documents such as a certified copy of the account, the Account Opening Application, specimen signature etc. to Bank of India branch address, along with a cheque/ DD for the outstanding balance in the SSY account.

- Once SSY Account transfer in documents are received at Bank of India, branch official will intimate customer about the receipt of documents.

- The customer is required to submit new SSY Account Opening Form along with fresh set of KYC documents.