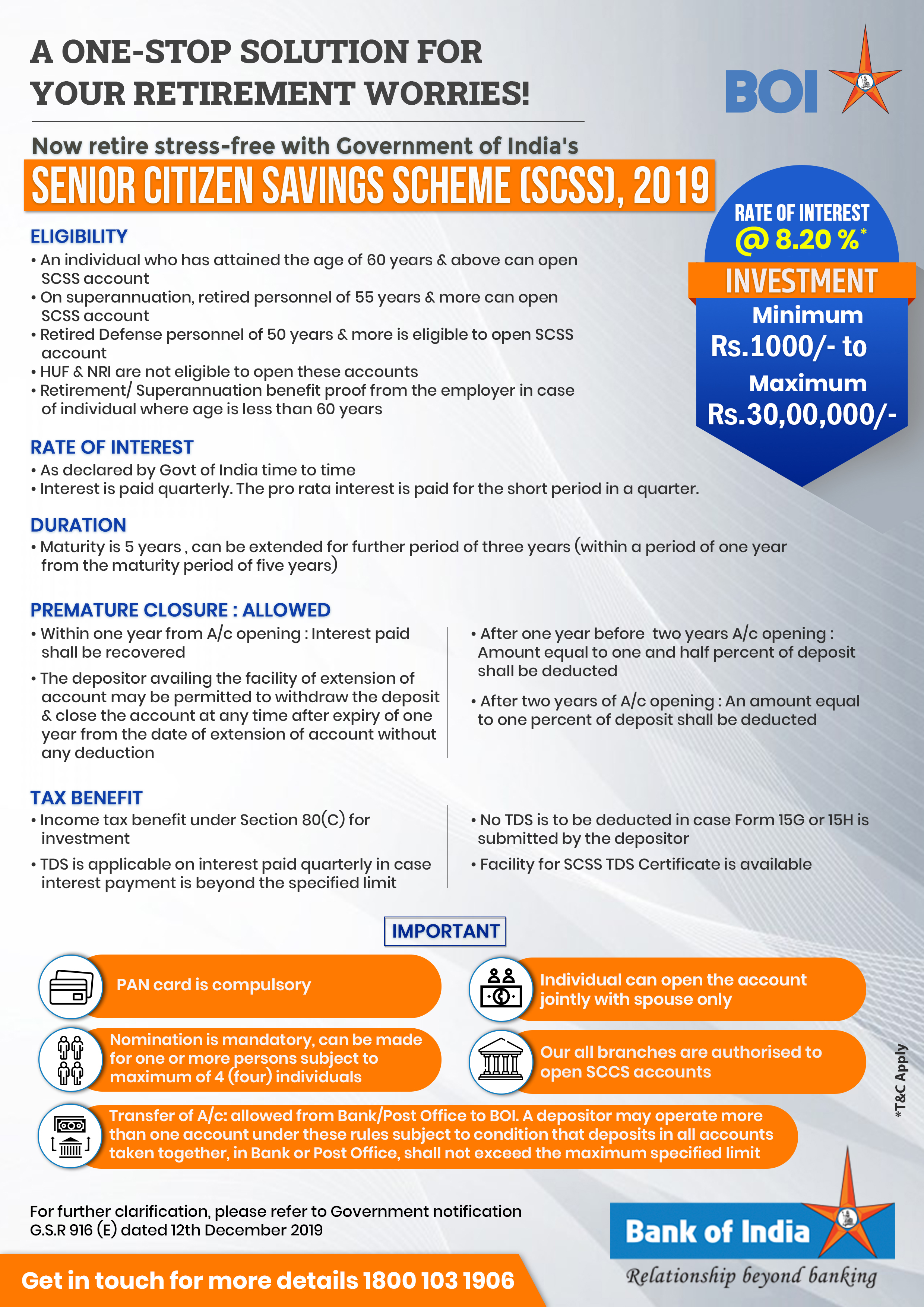

INVESTMENT

- The account can be opened with the minimum amount of Rs. 1000 and maximum amount of Rs 30 Lacs can be deposited in the account.

RATE OF INTEREST

- A/C holders will earn an annual interest of 8.20% . However, the interest rate is notified quarterly by Government of India.

- Interest earned on the deposit is calculated quarterly and credited into the savings account of the customer . The pro rata interest is paid for the short period in a quarter.

- Interest shall be payable from the date of deposit to 31st March/30th June/30th September/31stDecember on first working day of April/July/October/January, as the case may be, in the first instance and thereafter interest shall be payable on first working day of April/July/October/January as the case may be.

DURATION

- The maturity period for SCSS is 5 years .

- The depositor can extend the account only once, for a further period of three years by making an application to their parent branch within a period of one year after maturity.

BENEFITS

Easy Transfer

Account can be easily transferred to any of our Bank of India Branch.

Quarterly Interests Payment

Interest Rate

Lucrative interest rate

Guaranteed Returns

Reliable Investment Option

Tax Benefit

Tax benefit - eligible for tax deduction of upto Rs.1.50 lakhs u/s 80C of IT Act 1961

MULTIPLE ACCOUNTS

- A depositor may open more than one account under SCSS subject to the condition that the deposits in all accounts taken together shall not exceed the maximum limit and provided that more than one account shall not be opened in the same deposit office during a calendar month.

- In case of a joint account , if the first holder expires before the maturity of the account , the spouse may continue to operate the account on same terms & conditions, However, if the spouse has his/her individual account then the aggregate of both the accounts cannot be more than the prescribed maximum limit.

INCOME TAX PROVISIONS

Deposit in the account qualifies for deduction under section 80C of Income Tax Act.

TDS is applicable in case of interest payment beyond the specified limit.

Interest earned in the account is taxable.

No TDS is to be deducted in case of submission of Form 15G or 15H by the depositor

NOMINATION

- The depositor shall nominate mandatorily one or more individuals as nominee but not exceeding four individuals who in the event of death of the depositor will be entitled to payment due on the account.

- Joint Accounts - nomination can be made in this account also. However , the nominee’s claim arise only after the death of both the joint holders.

ELIGIBILITY

- An individual who has attained the age of 60 years & above can open SCSS account.

- The Person who has attained the age of 55 years or more but less than 60 years and who retired under a voluntary retirement scheme or a special voluntary retirement scheme on the date of opening of an account under these rules subject to the condition that the account is opened by such individual within three months of the date of receipt of the retirement benefits and proof of date of disbursal of such retirement benefit(s) along with a certificate from the employer indicating the details of retirement on superannuation or otherwise, retirement benefits, employment held and period of such employment with the employer.

- The spouse of the government employee shall be allowed to open an account under this Scheme, if the government employee who has attained the age of fifty years and has died in harness, subject to the fulfilment of other specified conditions, the Government Employee includes all Central and State Government employees eligible for retirement benefit or death compensation.

- The retired personnel of Defense Services shall be eligible to subscribe under this Scheme on attaining the age of 50 years subject to the fulfilment of other specified conditions.

- HUF & NRI are not eligible to open this account.

SCSS Accounts

OPEN YOUR ACCOUNT

- In order to open a SCSS account, please visit the nearest BOI branch and fill up the form A. The same form should be attached with KYC documents, age proof, ID proof, Address proof and cheque for deposit amount.

IMPORTANT NOTES

- PAN card is compulsory for availing this scheme.

- Nomination is mandatory and can be made for one or more persons subject to maximum of 4 (four) individuals.

- Individual can open the account jointly with spouse only.

- Transfer of A/c is allowed from Bank/Post Office to BOI. A depositor may operate more than one account under these rules subject to condition that deposits in all accounts taken together, in Bank or Post Office, shall not exceed the maximum specified limit. All our branches are authorized to open SCCS accounts.

- For further clarification, please refer to Government of India notification G.S.R 916 (E) dated 12th December 2019.

SCSS account can be transferred from one authorized bank or Post office to another. In such a case, the SCSS account will be considered as a continuing account. To enable customers to transfer their existing SCSS accounts from the other bank/post office to Bank of India, following process is to be followed

Customer requires to submit SCSS transfer request in the bank/post office(Form G) where SCSS account is held along with original passbook.

The existing bank/Post office will arrange to send the original documents such as a certified copy of the account, the account opening application, nomination form, specimen signature etc. along with cheque/DD of the outstanding balance in the SCSS account to Bank of India branch address provided by the customer.

Once SCSS transfer in documents are received at Bank of India, branch official will intimate customer about the receipt of documents.

Customer is required to submit fresh SCSS account opening form and Nomination form along with a fresh set of KYC documents.

SCSS Accounts

PREMATURE CLOSURE

The account holder has an option of withdrawing the deposit and close the account at any time after the date of opening the account subject to the following conditions which are as follows:

- In case, the account is closed before one year after the date of opening of account, interest paid on the deposit in the account shall be recovered from the deposit and the balance shall be paid to the account holder.

- 1.5% of the deposit shall be deducted if an account is closed after one year but before expiry of two years from the date of opening of account.

- 1% of the deposit shall be deducted if an account is closed on or after expiry of two years from the date of opening of account.

- The account holder availing the facility of extension of account, may withdraw the deposit and close the account at any time after the expiry of one year from the date of extension of the account without any deduction.

- In case of premature closure, interest on the deposit shall be payable upto the date preceding the date of premature closure after deduction of penalty.

- Multiple withdrawals from an account shall not be permitted.